Blog

Sharing insights, knowledge and expertise

Trending Posts

Cprime Enhances Technology-Driven Business Solutions Capabilities with INRY Acquisition

Addition of ServiceNow® Elite Partner bolsters Cprime capabilities in HR workflow optimization and Customer Service Management (CSM) READ THE PRESS…

Agile and AI: Navigating the Future

In the realm of software development, the integration of artificial intelligence (AI) with Agile methodologies marks a pivotal evolution. This…

Revolutionizing Product Development with Customer Intelligence Insights

Customer Intelligence FAQs addressed in this article: What is customer intelligence? - Customer intelligence is the process of gathering and…

Agile Reimagined: The Transformative Power of AI

Agile methodologies have reshaped software development with promises of flexibility, speed, and collaboration. Yet, there's a gap between these promises…

Navigating the Future of AI in Energy: Trends, Challenges, and Opportunities

Generative AI in Energy and Materials FAQs addressed in this article: What is generative AI's role in the energy and…

Unlocking New Horizons in Telco with Generative AI

Generative AI in Telco FAQs addressed in this article: What is generative AI's role in the telecommunications industry? - Generative…

Unlocking the Future of Efficiency: A Deep Dive into Modern Operational Excellence

Operational excellence FAQs addressed in this article: What is operational excellence in the modern business landscape? - Operational excellence in…

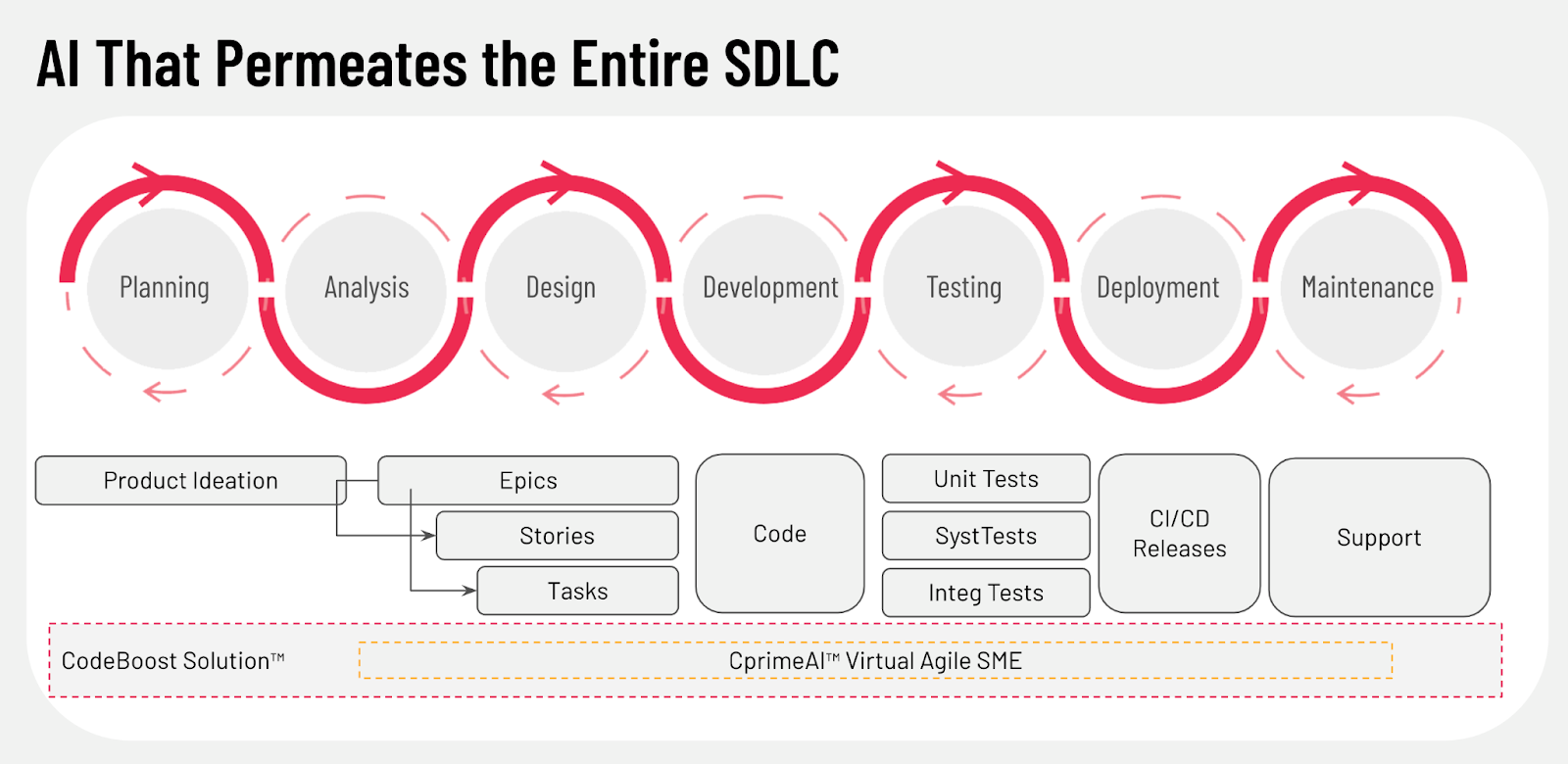

There’s So Much More to AI Coding Assistants Beyond Coding Suggestions

AI coding assistant FAQs addressed in this article: What are AI Coding Assistants? - AI Coding Assistants are tools designed…

Empowering Developers: The Key to Achieving Unparalleled IT Resilience

IT resilience FAQs addressed in this article: What is the strategic importance of developer empowerment in IT resilience? - The…

Maximizing Value with Technology Business Management: A Strategic Guide

Technology Business Management FAQs addressed in this article: What is Technology Business Management (TBM)? - TBM is a discipline dedicated…

The Strategic Imperative of Enterprise Architecture Management in Enhancing Business Outcomes

Enterprise Architecture Management (EAM) FAQs addressed in this article: What is the role of Enterprise Architecture Management in IT investment?…

Survey Results: Generative AI in Software Development Teams—Productivity and Challenges

Generative AI in Software Development FAQs addressed in this article: What percentage of software development teams are already using AI…